The Financial Page

The aim of this web page is to discuss the subject of money management. I plan to include small number of basic essays, so there is not a ton of information. I am motivated by my feeling that many treatments of these subjects by the media are over-simplified. My observation is that the media avoids suggesting that people do much in the way of actual work (not that the actual work is that difficult). Instead, shortcuts, financial "products" and oversimplifications abound.

In addition to the essays, I am launching an investment project, the aim of which is to demonstrate the application of the basic investment strategy outlined in the essay "Buy Low Sell High."

The Essays

The Investment Project

Here we will invest $10,000 in the stock and bond markets and see what happens. Rather than investing in individual stocks, which I personally regard as gambling rather than investing, we will invest in what are called "index funds." For simplicity, however, we will begin with what is called a "lifecycle" fund.

Progress reports, part 1 (lifecycle fund):

In June 2015, we switched to three index-type funds so that we could do re-balancing ourselves.

Progress reports, part 2 (two stock funds and one bond fund):

In November 2018 we added to our initial investment. We now compute results beginning January 1, 2019.

Progress reports, part 3 (two stock funds and one bond fund after adding more to the principle):

What's the point?

If you are lucky enough and skilled enough to have money to invest, then it is worth giving some thought to goals. Some people simply want "more." I'm not going to argue the point right now, but it is my firm belief that such people are currently destroying my country, the USA, and the world by accumulating stunning amounts of wealth and using that wealth to manipulate the rest of the world into giving them even more wealth, at the expense of us all.

I am advocating in favor of a more modest and sustainable goal: to have enough to live comfortably, whatever that means to you. For many people, spending more money each month means the difference between living in a rat-infested apartment with no reliable heat in the winter and living in a comfortable apartment or small house. Such people probably need to take steps to enable themselves to spend that extra money each month.

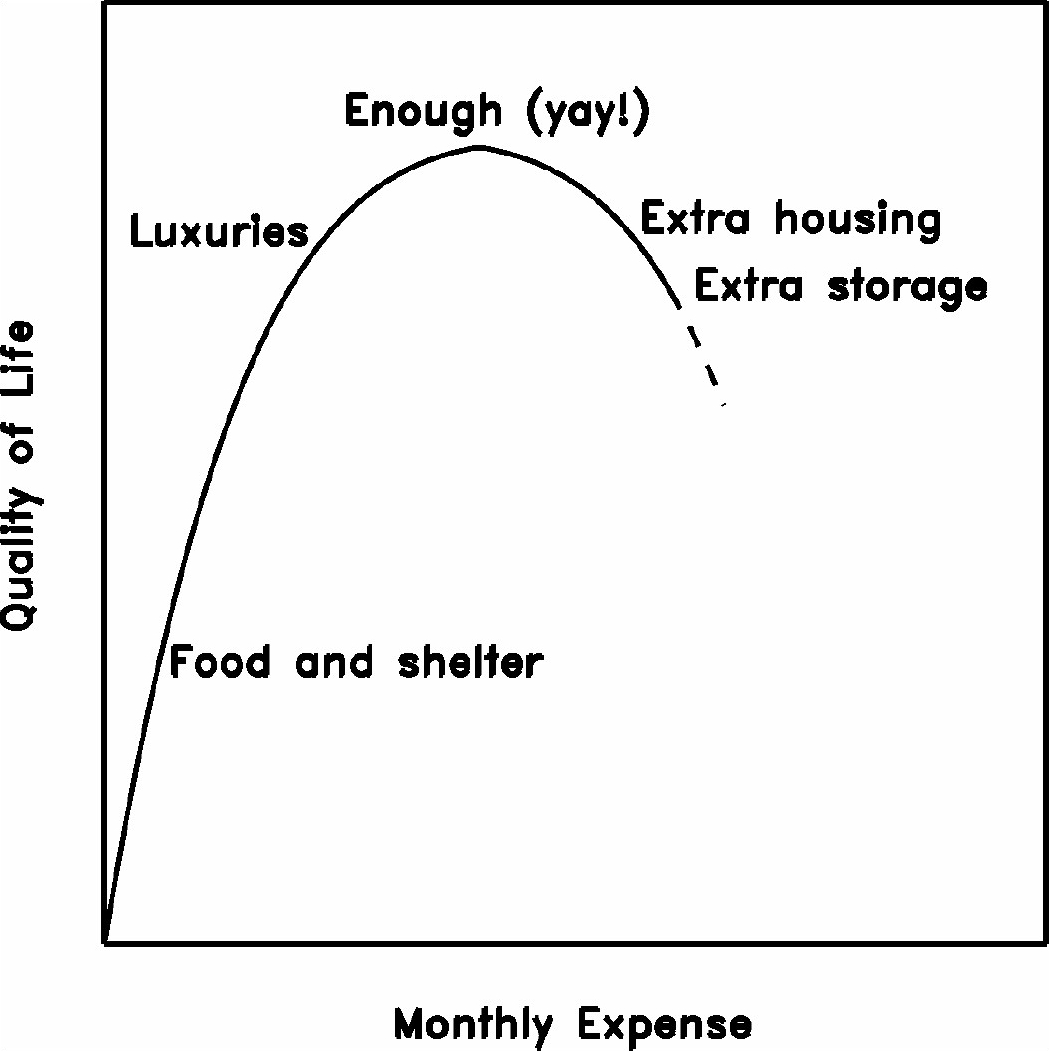

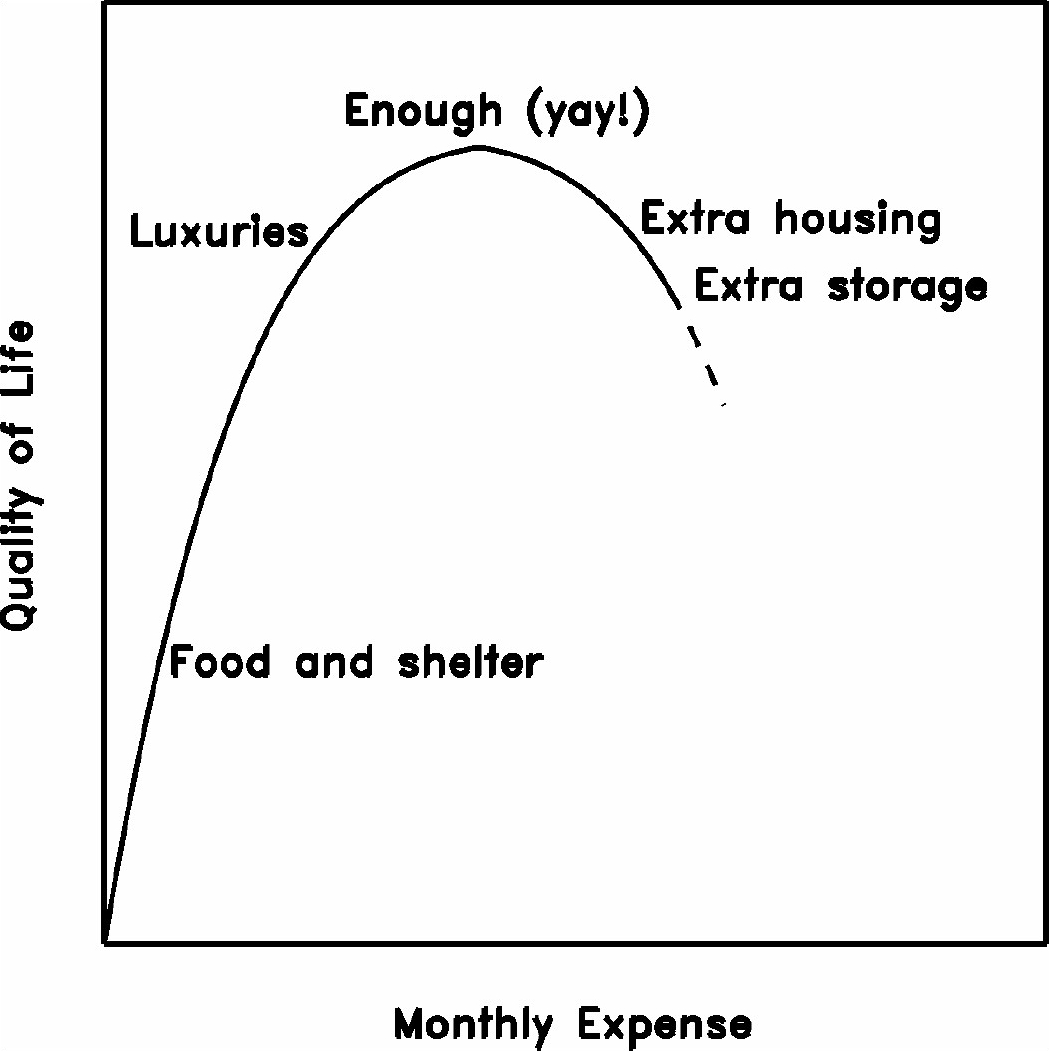

After a while, however, spending more money simply means piling up more stuff. Eventually you may be tempted to buy a bigger house just to have a place to put all that stuff. What is the point of that? Here is a diagram that I adapted from the book Your Money or Your Life, by Dominguez and Robbins:

As you can see, after getting enough stuff to have a nice life, there is not much point in getting more stuff. I'd just have to spend time storing and maintaining it. Better to get rid of it and risk having to re-purchase some of it than to spend money on a storage space or a bigger house to store it. For example, I see no reason to spend a lot of money on camping gear unless I am actively planning a camping trip. Otherwise, when I do get around to taking that long-planned-for camping trip I'll be tempted to replace half my gear with the the latest technology anyway.

Thus, my lifetime financial goals (some already accomplished) are to:

- Get into a habit of saving money

- Get enough stuff to have a nice, modest life

- Find out how much money I need to spend each month to maintain that modest life

- Save enough money that my investment income is greater than my needs

- Manage my money so that my investment income is sustainable

- Stop or cut back on paid employment in favor of things I enjoy more

- Adjust my lifestyle as needed to account for the fact that I am working less (or not at all)

Back to

Jonathan's Page

The Financial Page / Jonathan Krall / revised December 2021